An Investment Bank is a specific division of a bank related to the creation of capital for other companies.

The two main lines of business in investment banking are sell side and buy side.

An Investment Bank can also be split into private and public functions with an information barrier which separates the two to prevent information from crossing. The private areas of the bank deal with private insider information that may not be publicly disclosed, while the public areas such as stock analysis deal with public information.

Investment banking primarily comprises of three main areas:

Investment Banks offer services to both corporations issuing securities and investors buying securities and the activities are split into front office, middle office, and back office.

While large service Investment Banks offer all lines of businesses which include both “sell side” and “buy side”, smaller sell-side investment firms (Boutique Investment Banks and small broker-dealers) focus on investment banking and sales/trading/research, respectively. For corporations, Investment Banks offer information on when and how to place their securities in the open market, an activity which is very important to an Investment bank’s reputation. Therefore, Investment bankers play a very important role in issuing new security offerings.

While the large Global Banks such as Bank of America, Credit Suisse, Barclays Capital, JP Morgan Chase, Morgan Stanley, Citigroup, Deutsche Bank, UBS and Goldman Sachs typically offer all three services, smaller banks usually focus more on the investment banking division side covering advisory and mergers and acquisitions (M&A).

Investment Banking Services Include:

According to the Financial Times, in terms of total advisory fees for year to date 2015, the top ten investment banks were

| Rank | Company | Fees ($m) |

|---|---|---|

| 1 | Goldman Sachs & Co | 3,206.36 |

| 2 | JP Morgan | 3,205.52 |

| 3 | Bank of America Merrill Lynch | 2,649.19 |

| 4 | Morgan Stanley | 2,595.71 |

| 5 | Citi | 2,135.97 |

| 6 | Deutsche Bank | 1,888.55 |

| 7 | Barclays | 1,691.10 |

| 8 | Credit Suisse | 1,623.62 |

| 9 | Wells Fargo & Co | 1,173.54 |

| 10 | RBC Capital Markets | 1,056.62 |

| Total | 43,581.96 |

Source: http://markets.ft.com/investmentBanking/tablesAndTrends.asp

Most of us when dealing with banks usually walk into the branch and get our work done without bothering whether it is Retail Banking branch or a Corporate Banking branch.

The difference between Retail and Corporate Banking is that retail banking serves individuals and entities that are not corporates whereas corporate banking deals with large corporates.

The other end of the spectrum is the Investment Banking, which deals with high priced and low volumes deals like arranging for mergers and acquisitions, takeovers, and other deals aimed at the top notch of the management in the corporates.

Further, it must be mentioned that whereas Retail Banking is volumes driven, corporate banking is a combination of volumes and size of the transactions, Investment Banking is purely driven by the size of the deals where volumes are usually low as the lack of it is made up by the fees earned by the investment bankers in individual deals.

This means that the commissions (earnings for the Banks) on Retail and Corporate Banking range from low to medium whereas for investment banking they range from high to very high.

In recent years, there has been a new vertical that banks are targeting and this is Private Banking or Banking for the HNIs (High Net worth Individuals-Rich class people). This category of banking is purely directed towards individuals, entities, and trusts that have lot of money (indeed a fortune compared to retail consumers) which are then managed by the private bankers by assuring decent returns on the portfolios.

Private Banking sometimes encompasses all the other three arms as the presence of high Net worth individuals and entities can include rich retail banking customers, corporates and trusts that need their wealth to be managed, and finally clients who are mega rich in the same way investment bankers transact mega deals.

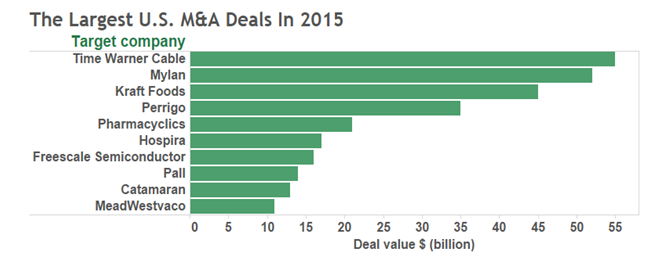

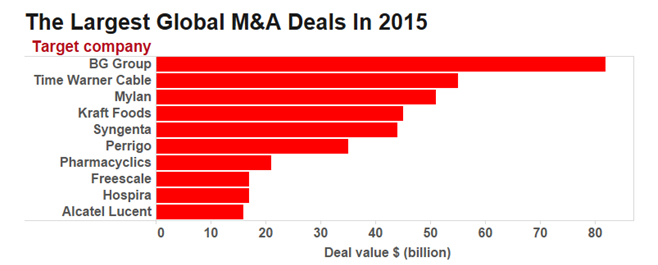

From the $55 billion Charter-Time Warner deal to the nearly-$50 billion Heinz-Kraft merger and everything in between, the first half of 2015 has been a busy time for merger and acquisition activity. According to data from Thomson Reuters analyzed by PricewaterhouseCoopers, the U.S. saw 4,654 M&A deals worth a whopping $875 billion from the start of the year through May 31. But what might be even more remarkable is that, according to the same analysis by PwC, the M&A market is just getting warmed up, and 2015′s merger market could be the best for the U.S. since the financial crisis.

According to professional services firm PricewaterhouseCoopers, 54% of CEOs in the U.S. plan to complete an acquisition in 2015. What’s more, the $875 billion in M&A deal value thus far marks a 9% increase over M&A deal value this time last year — two facts that are leading PwC to predict that the second half of 2015 could see even more merger activity in the back half of the year.