The Chartered Financial Analyst® (CFA) is one of the most respected and recognized investment designation in the world. The CFA® Program curriculum covers concepts and skills which you will use at all stages of your career. The Program connects academic theory with current practice and Ethical and Professional Standards to build a strong foundation of Investment Analysis, Corporate Finance, Valuations, Portfolio Management and Global Finance.

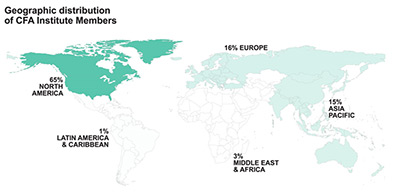

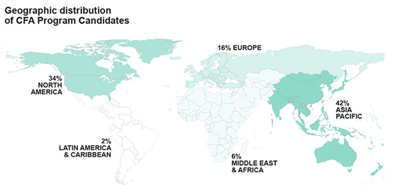

It is the globally recognized mark of distinction and benchmark for measuring the expertise, experience, and ethics of investment professionals. CFA Institute has more than 130,604 Members in 150 countries. There are 123,315 Charter holders worldwide.

To enroll in the CFA® Program, a candidate must:

One of the following:

For more Information visit https://www.cfainstitute.org/Pages/index.aspx/

CFA exam comprises three levels, a candidate has to pass all three levels sequentially in order to fulfill the requirements for gaining the Charter.

Exam for all levels occurs on first Saturday of June/December (December for level 1 only). For all levels exam occurs in a two sessions of three hours on same day (morning and afternoon session).

CFA exam entails a wide array of financial disciplines in order to educate a candidate to carve his/her way in the financial world. The various topics of study and their weights are as follows:

Subject Weights

| Topic Area | Level I | Level II | Level III |

|---|---|---|---|

| Ethical and Professional Standards | 15% | 10-15% | 10-15% |

| Quantitative Methods | 12% | 5-10% | 0% |

| Economics | 10% | 5-10% | 5-15% |

| Financial Reporting and Analysis | 20% | 15-20% | 0% |

| Corporate Finance | 7% | 5-15% | 0% |

| Equity Investments | 10% | 15-25% | 5-15% |

| Fixed Income | 10% | 10-20% | 10-20% |

| Derivatives | 5% | 5-15% | 5-15% |

| Alternative Investments | 4% | 5-10% | 5-15% |

| Portfolio Management and Wealth Planning | 7% | 5-10% | 40-55% |

| Total | 100 | 100 | 100 |

Note: These weights are regularly updated by CFA institute and are intended to guide the curriculum and exam development processes. Actual exam weights may vary slightly from year to year. Please note that some topics are combined for testing purposes.

Enrollment Fee

There is a one-time program enrollment fee when you register for your first CFA Program Level I exam.

| Program enrollment fee | US$ 450 |

Exam Registration Fees and Deadlines

June 2016 Exam (Levels I, II, and III)

| Early registration fee | US$ 650 | (ends 23 September 2015) |

| Standard registration fee | US$ 860 | (ends 17 February 2016) |

| Late registration fee | US$ 1,280 | (ends 16 March 2016) |

December 2015 Exam (Level I only)

| Early registration fee | Deadline passed | (ended 18 March 2015) |

| Standard registration fee | US$ 825 | (ends 19 August 2015) |

| Late registration fee | US$ 1,210 | (ends 16 September 2015) |

The different modes of payment available for a candidate to pay fees are as follows:

For more Information visit https://www.cfainstitute.org/Pages/index.aspx/

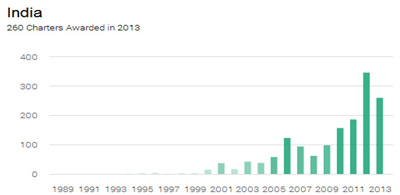

The number of charter holders is increasing every year in India, However, the supply is far lesser than the current and anticipated demand.

Source Source: http://www.cfainstitute.org/about/research/Pages/index.aspx

CFA Institute does not endorse, promote, review or warrant the accuracy of the product or services offered by CFEC or verify or endorse the pass rates claimed by CFEC. CFA and Chartered Financial Analyst are the trademarks owned by the CFA Institute. Global Association of Risk Professionals TM, Inc. (GARP®) does not endorse, promote, review or warrant the accuracy of the products or services offered by CFEC for FRM® related information, nor does it endorse any pass rates claimed by the provider. Further, GARP is not responsible for any fees or costs paid by the user to CFEC nor is GARP® responsible for any fees or costs of any person or entity providing any services to CFEC Study Program. FRM®, GARP® and Global Association of Risk Professionals TM, are trademarks owned by the Global Association of Risk Professionals TM, Inc.